Recent Articles

-

August Market Rate Update

Aug 12, 2025In July, the 5-year US Treasury rate showed exceptional stability, with both low volatility and lower peak levels than seen in recent months. These trends point toward a continued easing in interest rates, which could create favorable conditions for commercial real estate financing—especially for borrowers with strong credit and stabilized assets.Read More about August Market Rate Update -

How Can I Avoid Falling Into Debt?

Jul 24, 2025Avoiding high-interest debt starts with building smart financial habits like budgeting, using cash for everyday purchases, and setting up a dedicated emergency fund. By living below your means and removing spending temptations, you can stay in control of your finances. Even small, consistent changes can lead to long-term financial stability and peace of mind.Read More about How Can I Avoid Falling Into Debt? -

Please welcome Mike Fogle to the IAACU team!

Jul 16, 2025We’re excited to welcome Mike Fogle as our new Assistant Vice President of Business Services, effective June 30, 2025.Read More about Please welcome Mike Fogle to the IAACU team! -

July Market Rate Update

Jul 15, 2025The 5-year U.S. Treasury yield has shown signs of stabilizing in July, averaging around 3.92% after a slight dip from June’s levels. This shift suggests the market is adjusting to previous rate hikes and entering a more neutral phase. As a result, commercial real estate financing conditions remain favorable, particularly for borrowers seeking to capitalize on steady rates and lender interest in well-positioned assets.Read More about July Market Rate Update -

About Our Art...

Jul 2, 2025Jeremy Langston, an artist and educator, showcases The View From the Road, a series of vibrant landscapes inspired by the American West’s roadside vistas. Through layered techniques and bold color, his paintings reflect the grandeur of natural scenes accessible to all, celebrating their role in shaping the American visual identity. The exhibit runs July through September 2025 at the IAA Credit Union in Bloomington, IL.Read More about About Our Art... -

Good Money Habits to Start in Your 20's

Jun 26, 2025Your 20's are the ideal time to build smart money habits that can set the stage for lifelong financial success. From setting clear financial goals and creating a budget to building credit, saving for emergencies, and starting to invest early, these foundational steps can help you take control of your financial future. With consistency and a willingness to learn, the small decisions you make today can lead to big rewards tomorrow.Read More about Good Money Habits to Start in Your 20's -

We’re excited to welcome Phil Gelato to the IAACU team!

Jun 5, 2025We're excited to welcome Phil Gelato to IAA Credit Union as our new Member Experience Supervisor, effective June 2, 2025.Read More about We’re excited to welcome Phil Gelato to the IAACU team! -

June Market Rate Update

Jun 4, 2025The 5-year U.S. Treasury yield saw a modest uptick in May, breaking a four-month decline and signaling a possible shift in momentum. Forecasts suggest the yield will gradually rise through June, influencing commercial real estate loan rates to remain competitive between 6.50% and 7.10%. We thank our business members for the overwhelming support during Small Business Month!Read More about June Market Rate Update -

Achieve Homeownership With IAACU!

Jun 2, 2025Homeownership is a significant financial decision, and IAA Credit Union (IAACU) offers guidance throughout the mortgage process. Our Mortgage Team is recognized for excellent service, with competitive fees and personalized support to ensure a smooth experience.Read More about Achieve Homeownership With IAACU! -

May Market Rate Update

May 6, 2025May is National Small Business Month, making it the perfect time for business owners to revisit commercial real estate financing. With the 5-year Treasury yield trending down for the third straight month, borrowers could benefit from more favorable loan pricing. To celebrate, IAA is offering limited-time rate discounts and reduced closing costs for COUNTRY agents and referred policyholder businesses.Read More about May Market Rate Update -

Are You Making These Financial Mistakes?

Apr 24, 2025It can be easy to make mistakes with money. It's easy to make mistakes with anything. However, with money, certain pitfalls are easier to avoid than others. Here are some common money mistakes that can be avoided with just a bit of work.Read More about Are You Making These Financial Mistakes? -

April Market Rate Update

Apr 21, 2025This month’s Market Rate Update covers both March and the first half of April, highlighting a quiet March followed by increased volatility in early April. Despite the fluctuations, the overall trend points to gradually declining rates, with 5-year Treasury yields expected to settle below 4.00%. If this continues, commercial loan rates could follow suit—making now a great time to explore your financing options with IAA Credit Union.Read More about April Market Rate Update -

About Our Art...

Apr 10, 2025Jeannie, a lifelong Bloomington-Normal resident, has explored a wide range of artistic expressions—from watercolor and sculpture to assemblage art using repurposed vintage materials. Her signature “Small Frames” is made from reclaimed picture frame samples. Her artwork will be on display at IAA Credit Union from April through June 2025.Read More about About Our Art... -

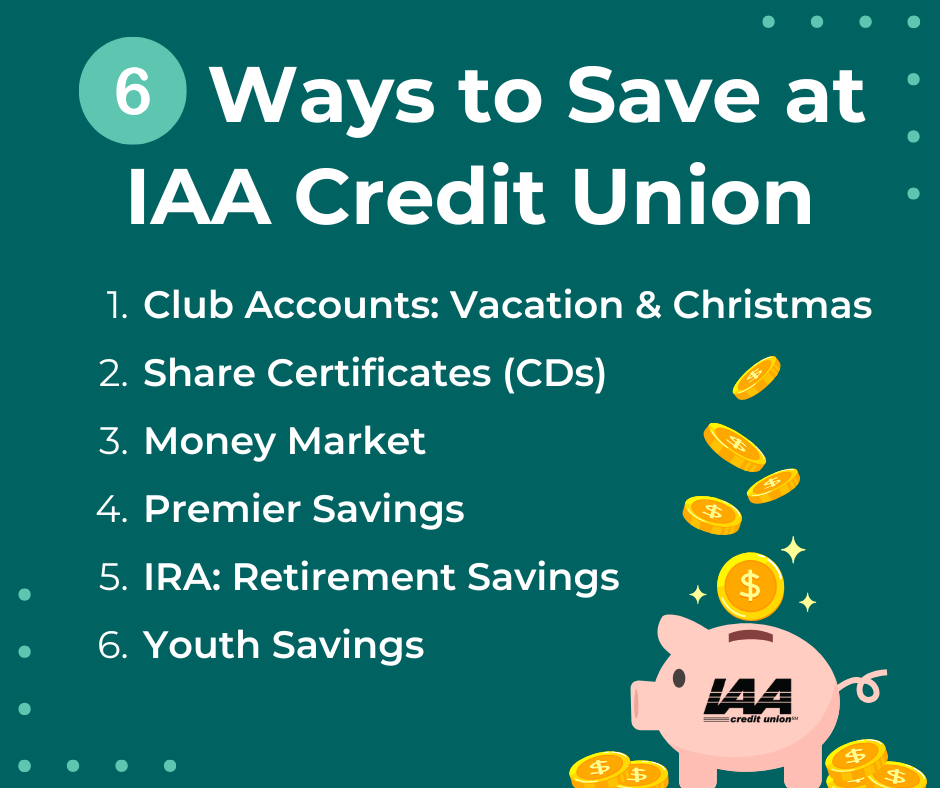

6 Ways to Save at IAA Credit Union

Apr 4, 2025Many of us have goals that likely include building a better financial foundation for ourselves. Building a healthy financial foundation involves developing sound savings habits. IAA Credit Union offers a variety of savings options to fit all your different savings goals.Read More about 6 Ways to Save at IAA Credit Union -

Raising Money-Smart Kids

Apr 1, 2025April is National Credit Union Youth Month! At IAA Credit Union, we believe in helping our families raise money-smart kids. Financial education starts early, and the lessons children learn today will shape their financial habits for a lifetime. Yet, many parents find it challenging to introduce these concepts at home. That's why we have developed our Youth Program with tools and resources to help you in raising money-smart kids.Read More about Raising Money-Smart Kids -

How to Protect Your Credit from Identity Theft

Mar 25, 2025To close out National Credit Education Month, it’s important to take proactive steps to protect your personal and financial information from identity theft. Freezing your credit, regularly checking your credit reports, and setting up online purchase alerts can help safeguard your accounts and prevent fraudulent activity. Experts also recommend freezing your child’s credit to prevent long-term identity fraud that could go unnoticed for years.Read More about How to Protect Your Credit from Identity Theft -

March 2025 Market Rate Update

Mar 5, 2025Interest rates have declined, with the 5-year U.S. Treasury dropping below 4% due to falling consumer confidence and tariff concerns. If this trend continues, commercial real estate loan rates at IAA Credit Union could drop to 6.35%-7.15%. Reach out to us to discuss your target rate, and we’ll monitor the market to lock it in when the opportunity arises.Read More about March 2025 Market Rate Update -

IAA Credit Union Welcomes Emily Mcleod as Chief Experience Officer

Mar 3, 2025IAA Credit Union (IAACU) is pleased to announce that Emily Mcleod has been named the first-ever Chief Experience Officer (CXO) effective February 24, 2025.Read More about IAA Credit Union Welcomes Emily Mcleod as Chief Experience Officer -

How Can I Build a Stronger Credit Profile?

Feb 19, 2025Improving your credit score is essential, as it impacts everything from loan interest rates to job background checks. Start by regularly monitoring your score through tools like My Credit Score from IAA Credit Union, and take proactive steps such as paying bills on time, keeping credit utilization low, and disputing any errors on your credit report. By practicing good credit habits and avoiding unnecessary new credit applications, you can steadily build a stronger financial profile.Read More about How Can I Build a Stronger Credit Profile? -

David Warren Sr. Promoted to Chief Lending Officer

Feb 12, 2025IAA Credit Union (IAAC) is proud to announce the promotion of David Warren Sr. to Chief Lending Officer (CLO), effective February 8, 2025.Read More about David Warren Sr. Promoted to Chief Lending Officer